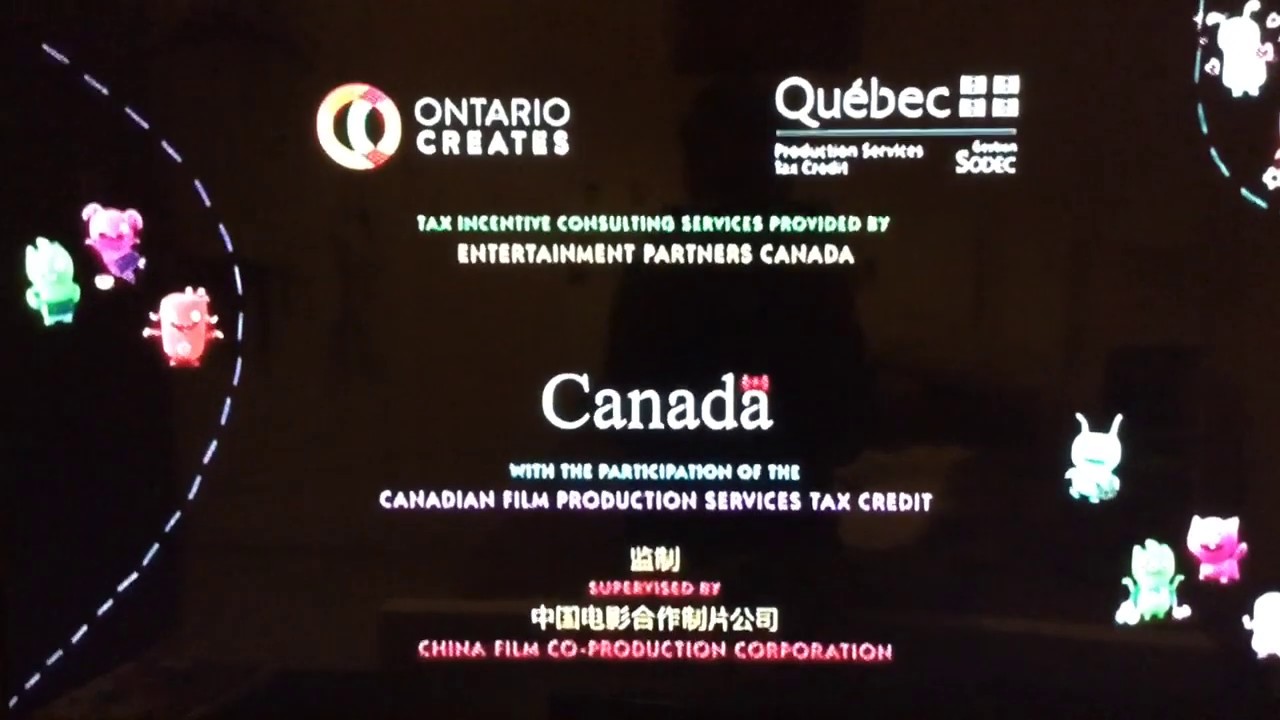

canada film or video production tax credit logo

The Canada Revenue Agency and the Department of Canadian Heritage through the Canadian Audio-Visual Certification Office jointly administer this tax credit. If eligible for the CPTC your corporation can get a refundable tax.

Tristar Pictures In Association With Block Hanson In Association With Wingnut Films As A Wingnut Films Production Canadian Film Or Video Production Tax

Qualified labour expenditures are limited to 60 of the amount by which the cost of the production exceeds assistance.

. When your clients spend money to make a film in Canada part of those video production costs go for labour. The Canadian Film or Video Production Tax Credit program and the Film or Video Production Services Tax Credit program. Tax liabilities waivers and guidelines for non-residents in the film and television industry.

Canada The Canadian Film Video Tax Credit Logo - 16 images - exploring canadian identity in canadian tv canada canadian television fund like success the legion of decency the hole in daddy s arm fremantle media teletoon. That means if your client spends 100000 on qualifying labour expenses they can get a credit of 25000. There is a silence version of the phrase The Canada Film or Video Production Tax Credit.

There is a long version of the end credits that might be logo. The Film or Video Production Services Tax Credit PSTC provides eligible production. Canadian Film or Television Program Tax Credit Fund.

Co-administered by the Canadian Audio-Visual Certification Office and the Canada Revenue Agency the PSTC is designed to enhance. Form T1131 Canadian Film or Video Production Tax Credit. The Canadian film or video production tax credit CPTC encourages both production in Canada and Canadian programming.

CAVCO is also responsible for the administration of the CAVCO Personnel Number also referred to as. To qualify as an accredited production eligible for the PSTC credit the filmvideoseries must meet. The TV Shows can be the phrase The Canadian Film or Video Production Tax Credit or be shortened to The Canadian Film or Video Tax Credit.

Qualified labour expenditures are limited to 60 of the amount by which the cost of the production exceeds assistance. The Manitoba Tax Credit is compatible with the Canadian Film or Video Production Tax Credit CPTC and the Film or Video Production Services Tax Credit PSTC which are co-administered by the Canadian Audio-Visual Certification Office CAVCO and CRA. Talk shows are only eligible for the federal credit the Canadian Film or Video Production Tax Credit administered by CAVCO where principal photography began after February 16 2016.

Community content is available under CC-BY-SA unless otherwise noted. The Canadian Audio-Visual Certification Office CAVCO co-administers two federal tax credit programs with the Canada Revenue Agency. The CPTC allows you to claim a credit for 25 of these labour costs as long as they meet the qualifications.

Employees residency status determines if salaries and remuneration you paid qualify for tax credits. There are three versions. Federal Tax Credits Canadian Film or Video Production Tax Credit CPTC The CPTC is 25 of qualified labour expenditures for the year in respect of the production.

The Film or Video Production Services Tax Credit PSTC provides eligible production corporations with a tax credit at a rate of 16 per cent of the qualified Canadian labour expenditures incurred in respect of an accredited production. Dwayne Johnson Carla Gugino Alexandra Daddario Colton Haynes. Brad Peyton Stars.

The CPTC is therefore capped at 15 of the cost of the. The 2021 film and video tax credits allow productions to avail a refundable tax credit of up to 25 of the qualified labour expenses. The National Film And Bank Of Canada Kids Cbc Shaw Rocket Fund The Canadian Film Or Video Production Tax Credit Four Logos The Canadian Film or Video Production Tax Credit CPTC provides eligible productions with a fully refundable tax credit available at a rate of 25 per cent of the qualified labour expenditure.

The film or video production services tax credit PSTC encourages Canadian and foreign-based producers to employ the services of Canadians. Film or Video Production Services Tax Credit PSTC The PSTC is a 16 refundable tax credit on qualified Canadian labour expenditure incurred by producers of filmstelevision that do not meet the Canadian-content requirements for the CPTC. The Canada Revenue Agency and the Department of Canadian Heritage through the Canadian Audio-Visual Certification Office jointly administer this tax credit.

If eligible for the PSTC your corporation can get a refundable. Fill out the following forms and send them to the Canada Revenue Agency CRA along with your CAVCO certificate or a copy. Get a Canadian film or video production certificate Part A or a certificate of completion Part B from the Canadian Audio-Visual Certification Office CAVCO.

The CRA administers provincial film and media tax credits for the provinces of British Columbia Manitoba and Ontario. In the aftermath of a massive earthquake in California a rescue-chopper pilot makes a dangerous journey with his ex-wife across the state in order to rescue his daughter. Talk shows have always been and continue to be ineligible for all Ontario tax credits including the OFTTC OPSTC OCASE and OIDMTC.

Out Of Context Simpsons Couch Gags On Twitter Stephen Hillenburg Nickelodeon Spongebob Squarepants

Closing To Uglydolls 2020 Dvd Australia